Q2 State of Market: CAB members ‘getting on with life’

July 2019

|

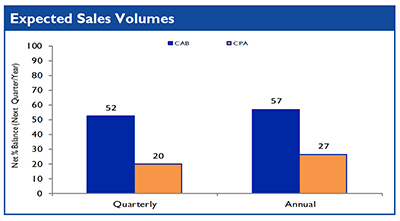

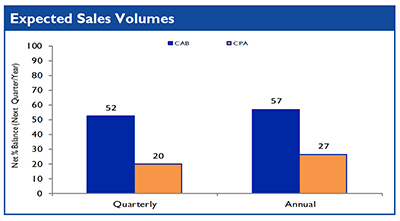

The latest RICS Construction and Infrastructure Market Survey (Q2) clearly reinforces the results of the CAB State of Market Survey ((Q2) that shows that the construction industry is getting on with life as its patience with Brexit related indecision wears thin. The RICS Survey highlighted increases in sales volumes/workloads by 25% net balance with the CAB Survey reporting 52% net balance for Q2 and 52% and 57% forecasted for Q3 and the year ahead respectively. Both surveys indicated increases in capital investment in machinery/equipment, with the CAB survey indicating 60% net balance growth in the last year and 75% net balance forecasted for the next 12 months.

CAB members undertaking the Q2 Survey were particularly positive about capital investment as they forecasted an increase in spend in the year ahead on all metrics. After plant & equipment was product improvement (62% net balance) and property and R&D (both 50%) and customer research (45%).

Looking at the sales compared to a year ago, 30% of members reported a rise above 5% and 40%, a rise of up to 5%. Only a total of 15% of members reported any reduction (up to 5% or more than 5%).

Overall CAB members expected overall cost inflation to persist but there was a slightly lower level of concern than in last quarter (38% compared to 47% net balance) expecting increases in the next quarter and almost the same net balance expecting increases over the next 12 months (57% compared to 58% net balance).

Continued demand for skilled labour placed upward pressures on wages and salaries with 76% net balance of members highlighting it as a key cost factor. Raw materials was slightly lower at 48% (compared to 68% in Q1) but lingering high energy costs (76% net balance compared to 63% in Q1) also continued to exert upward pressure on manufacturers input costs.

While demand was reported to be the key constraint on sales growth over the next 12 months only 48% (compared to 63% in Q1) of CAB members reported that it was likely to be the key constraint on sales over the next 12 months. The other major constraints were labour availability (19%), capacity (14%) and raw material prices (10%). However, 10% of members reported no constraints.

Confidence in the year ahead encouraged CAB members to forecast a higher headcount in the year ahead at 62% (47% net balance in Q1).

Overall capacity levels were again reported to be sufficient in Q2 given sector output and demand. 29% of members reported that they had operated at between 90% and full capacity over the last 12 months (17% in Q1). In a year’s time, capacity utilisation was expected to be 90% or higher according to 38% of members (22% in Q1).

For further information on CAB, its activities and how to join, please contact Jessica Dean jessica.dean@c-a-b.org.uk or ring 01453 828851

|