Government policy to prolong the agony

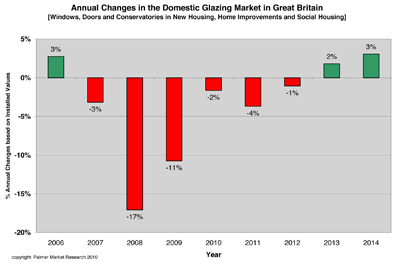

The market for windows, doors and conservatories fell by 11% in 2009 to £3.85billion, according to Palmer Market Research (PMR)’s 2010 report on the Window, Door and Conservatory Markets in Housing in Great Britain.

“This is actually better than we were anticipating last year,” said Robert Palmer, PMR’s managing director. However, this will be little solace to the industry, which Palmer forecasts will continue to see decline until 2013, as the new government’s economic policies kick in.

This will be the third year in which the market has decreased, following record highs in the mid 2000s, where the annual value of the market vacillated around £5.2billion, peaking at £5.4billion in 2006.

Patio doors showed the biggest decline, with their installed value reducing dramatically by 21%. Entrance doors dropped by 13%, secondary glazing by 11%, conservatories by 10% and windows by 9%. The window market in the home improvement sector actually shrunk to its lowest level since 1986, while in new build housing, it declined by 18% to a post war record low. And Palmer forecasts that windows and entrance doors will continue to decline through 2012. The chart taken from figures in the report, illustrates the shrinking market, at least until 2013.

All sectors within the market – new-build, home improvements and social housing – declined in 2009. Home improvements, the biggest sector, covering around 80% of the market, declined to its lowest level since 2000.

There are some individual success stories. Installations of bifold doors increased by 33%, albeit from a very low base. And composite doors (defined in this report as being those made from an internal framework and cellular foam core with GRP, PVC or ABS facings) grew by 8%.

Palmer paints a pessimistic picture of the home improvement market, which will continue to be hit by low consumer confidence, and social housing, likely to suffer heavily under the new government’s proposed cutbacks.

However, new housing is likely to start seeing recovery immediately, boosted by the various shared equity schemes on offer. And, happily for the glazing market, the trend is now back towards larger family houses and away from flats, a fact that prompted Palmer to predict the new housing window market to grow by 15% in 2010, and 13% in 2011.

www.palmermarketresearch.co.uk